Thanks to DLShowOnline.com This post originally was featured on DLShowOnline.com

This is a continuation from last week’s show: Look What The Banks Are Doing Be sure and watch this weeks video below. You don’t want to miss it!

This is a continuation from last week’s show: Look What The Banks Are Doing Be sure and watch this weeks video below. You don’t want to miss it!

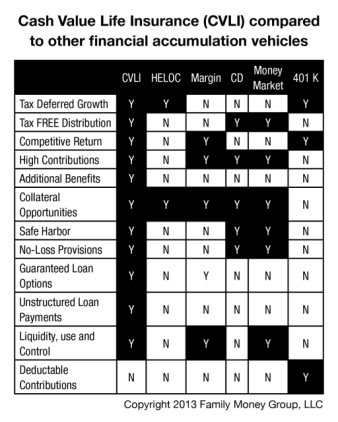

Why is this show titled “Look What The Wealthy Are Doing”? Because, under the current IRS tax code, a properly structured cash value life insurance policy, is one of the few assets that provide tax-advantaged access (I.E. Tax-Free Distribution). In fact, when setup properly, they are treated and taxed exactly like a ROTH IRA. (Both are governed by IRS code section 7702) .

It should be noted that many agents do not understand how to setup a policy in this fashion. You should be 100% certain you are working with someone that is an expert in this area. When the right policy is put in place, not only are the proceeds tax-free, but there are much higher contribution limits when compared to ROTH IRAs. (Many people fund these plans at $60,000 per year or more. Compare this to the limitations of ROTH IRA’s and the fact that many high income earners can’t event participate in a ROTH IRA.

See the entire list of benefits discussed on this broadcast, go HERE (Also watch the video below)

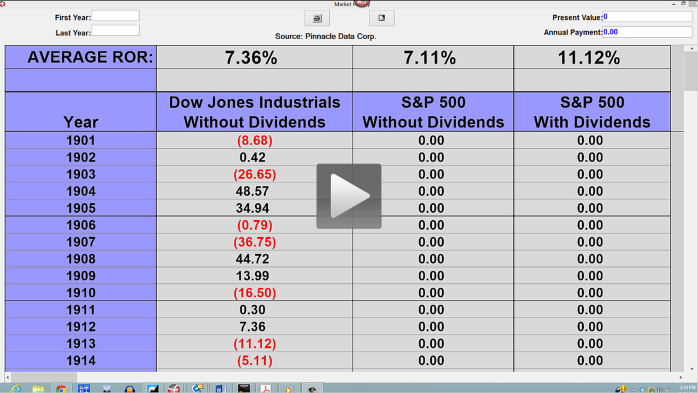

Watch the video below to see David give a detailed analysis Of a Cash Value Life Insurance Policy VS. an alternative market based account. There is a lot of negative information out there about cash value life insurance. Much of it is based on a misunderstanding of how these policies work . In fact, many life insurance agents don’t even know how to setup a policy to maximize the living benefits that a contract offers.

Watch the video below to see David give a detailed analysis Of a Cash Value Life Insurance Policy VS. an alternative market based account. There is a lot of negative information out there about cash value life insurance. Much of it is based on a misunderstanding of how these policies work . In fact, many life insurance agents don’t even know how to setup a policy to maximize the living benefits that a contract offers.

Additional Resources to learn more:

SEE: Look What The Banks Are Doing

10MinuteLessonOnLifeInsurance.com

Also see the video: Borrowing Strategies.

David and his firm specialize in these advanced insurance strategies and can assist you further on this topic. David and his team can be reached at: (800) 559-0933.

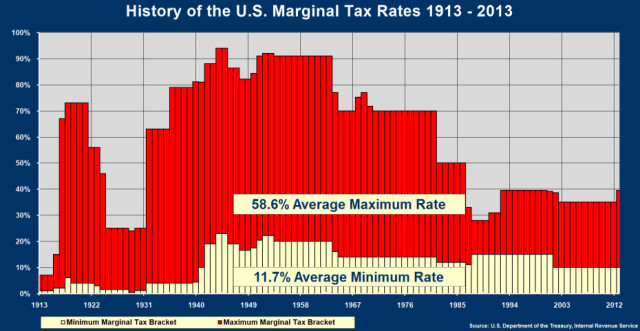

As David promised on this broadcast, below is the Federal Income tax rate history since its inception in 1913.